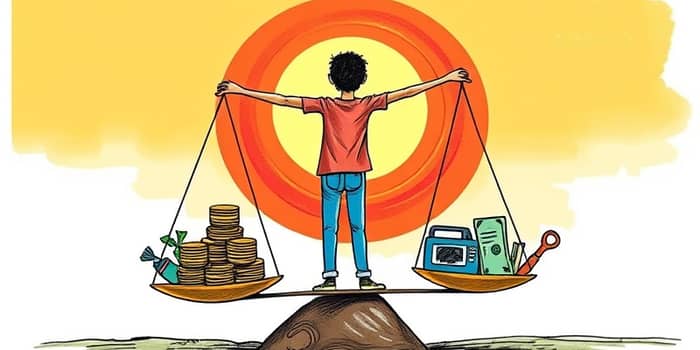

In an age of rising living costs and economic uncertainty, mastering effective spending habits is no longer optional—it’s essential. By adopting intentional strategies and disciplined frameworks, anyone can transform limited resources into lasting financial stability.

Whether you’re just starting your money journey or looking to refine existing practices, the following guide will inspire and equip you to make every cent count.

The consumer reality of 2025 is defined by cautious optimism. Studies show Gen Z has reduced non-essential purchases by double digits, and overall U.S. spending growth remains stagnant despite healthy employment.[5][7] To thrive, individuals must demonstrate true financial prudence in every decision.

Generational powerhouses like Gen X and Gen Z wield trillions in spending potential, but both groups are tightening belts. 74% of shoppers worry about price hikes for daily essentials[13], while families clip coupons and switch to generic brands[5]. Recognizing these trends helps you anticipate industry shifts and reinforce your own habits.

A clear budget is the cornerstone of fiscal fitness. Start by calculating your net income from all your sources, then map fixed obligations like rent, utilities, and debt, followed by variable costs like entertainment and dining.

Once you’ve chosen a method that resonates—whether manual ledgers, digital tools, or the classic envelope system—you can follow these steps to establish a living budget:

Creating a budget is only half the battle. To extract maximum value, set targets that are 20–25% below your usual daily spending. This automate savings with set-it-and-forget-it transfers mindset builds cushion without constant decision fatigue.

Regularly revisit atypical costs—membership fees, subscriptions, and annual dues—to ensure they still provide value. Brainstorm unusual expenses like car repairs or medical bills before the year begins, then factor them into your projections to avoid mid-year surprises.

Emergency preparedness and debt management are vital pillars. Aim to hold three to six months’ worth of expenses in an accessible, high-yield savings account. This buffer shields you from income disruptions and unexpected bills.

Separate your spending into essentials (housing, groceries), discretionary treats (dining out, hobbies), and atypical costs (holiday gifts, annual subscriptions). Calculating your debt-to-income ratio and reviewing all income streams—salary, investments, side hustles—will clarify where to allocate surplus funds for the greatest impact.

Today’s consumers pivot toward frugality yet refuse to sacrifice quality or convenience. Gen Z favors mobile shopping (74%) but also seeks experiences worth investing in (59%). Understanding these priorities helps you choose where to save and where to spend.

By aligning spending with your values—whether that’s sustainability, convenience, or memorable experiences—you create a budget that feels empowering, not restrictive.

Leveraging digital tools can transform budgeting from chore to insight. Mobile apps reveal patterns you might miss and can trigger alerts for overspending or upcoming bills. Coupling tech with clear objectives ensures you stay on track.

Define goals that are specific, measurable, achievable, relevant, and time-bound. For instance, “Save $3,000 for an emergency fund by December” is far more actionable than “save more money.”

By combining digital insights with structured goal-setting, you create a dynamic system that grows and adapts with your needs.

Empowered by knowledge, clear systems, and adaptable tools, you can maximize every dollar you invest and spend. Cultivating discipline today paves the way for tomorrow’s opportunities—whether that’s debt freedom, early retirement, or the joy of stress-free living.

Start small, stay consistent, and revisit your strategy regularly. Your future self will thank you for every thoughtful choice you make along the way.

References